RBI

| March 23, 2024, 5:28 a.m.

RBI Central Board Reviews Economic Situation, Approves Budget for 2024-25

The Reserve Bank of India's Central Board of Directors, chaired by Governor Shaktikanta Das, convened in Nagpur to assess the global and domestic economic landscape. The Board addressed challenges stemming from geopolitical tensions and financial market volatility. Additionally, discussions encompassed the Reserve Bank's initiatives in digital payments and consumer education during the fiscal year 2023-24. Notably, the Board approved the Bank's budget for the upcoming fiscal year 2024-25.

Read More.| March 14, 2024, 4:51 a.m.

NHAI Advises Paytm FASTag Users to Obtain New FASTag from Another Bank Amid Crisis

In light of the ongoing crisis surrounding Paytm, the National Highways Authority of India (NHAI) has issued guidance to Paytm FASTag users, urging them to acquire a new FASTag from another bank before March 15. Following this date, Paytm FASTag users will no longer be able to recharge or top-up their balances, although they can continue using their existing balance for toll payments. NHAI emphasized the importance of obtaining a new FASTag to avoid penalties or double fee charges while traveling on National Highways. The Reserve Bank of India (RBI) had previously advised customers and merchants of Paytm Payments Bank Ltd (PPBL) to transition their accounts to other banks by March 15. Despite the ongoing Paytm crisis, the NHAI assures the continuity of FASTag operations, an electronic toll collection system utilizing Radio Frequency Identification (RFID) technology for toll payments.

Read More.

India's Economy Likely To Grow by 7 percent in 2024 and 2025,Inflation to ease:Says RBI Governor

| Jan. 17, 2024, 3:05 p.m.

India's Economy Likely To Grow by 7 percent in 2024 and 2025,Inflation to ease:Says RBI Governor

RBI Governor said that India's economy will grow by 7 percent and inflation will also reduce.

Read More.

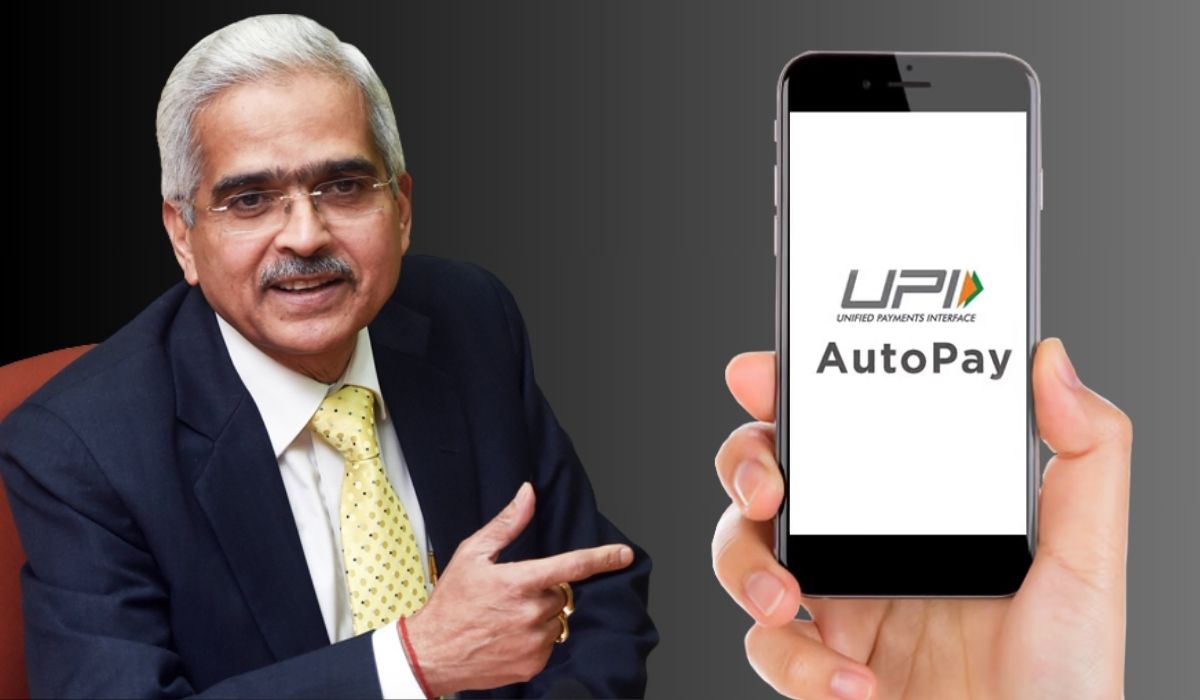

RBI, UPI, Automatic Payment Limit, Increase, Rs 1 Lakh, Digital Transactions

| Dec. 13, 2023, 11:33 a.m.

RBI Raises Automatic payment limit via UPI to Rs 1 lakh.

Reserve Bank Of India Raises Automatic Payment Limit For UPI upto 1 Lakh Rs per transaction From the Existing Rs 15000 For certain Categories from tuesday 12-12-2023 .

Read More.

"ICICI Bank Penalized ₹12 Crore, Kotak Bank Fined ₹3.95 Crore by RBI"

| Oct. 18, 2023, 11:22 a.m.

"ICICI Bank Penalized ₹12 Crore, Kotak Bank Fined ₹3.95 Crore by RBI"

The Reserve Bank of India (RBI) has imposed economic consequences on ICICI Bank and Kotak Bank, amounting to ₹12 crore and ₹3.Ninety five crore, respectively, as part of regulatory moves, highlighting the valuable financial institution's commitment to preserving subject and responsibility within the banking sector.

Read More.

RBI Imposes ₹5.39 Crore Penalty on Paytm Payments Bank for Violating Norms

| Oct. 13, 2023, 12:01 p.m.

RBI Imposes ₹5.39 Crore Penalty on Paytm Payments Bank for Violating Norms

The Reserve Bank of India (RBI) has imposed a penalty of ₹5.39 crore on Paytm Payments Bank for breaching a series of financial norms. This action underscores the central bank's commitment to enforcing regulatory compliance in the financial sector.

Read More.Stories

Latest News